How to Use Your HSA

Triple-Tax Advantage

HSAs provide financial flexibility, promote savvy healthcare decision-making, encourage financial growth, and offer tax advantages. Enjoy tax-deductible contributions, tax-free earnings and tax-free distributions for qualified expenses.

Pays for Healthcare

Your HSA funds can be used to pay your deductible. HSAs also cover doctor visits, over-the-counter medications, and many other medical expenses. When you pair a high-deductible health plan with an HSA, low-deductible (high premium) health plans don’t stand a chance.

Rollover Funds

Invest in Your Future

Take the Reins

Keeping it Simple

Contribute

Grow your health savings simply by contributing. Just think about how much you’re saving on premiums, then put those savings in your HSA. Link your bank account to your HSA to contribute tax-free at any time.

Apply

Swipe your MotivHSA card as a credit card when you are at the doctor’s office or pharmacy. This allows you to pay for medical expenses tax-free.

Invest

Investing your HSA funds is one of the fastest ways to help them grow. Call our PHAs at 844-234-4472 with any questions.

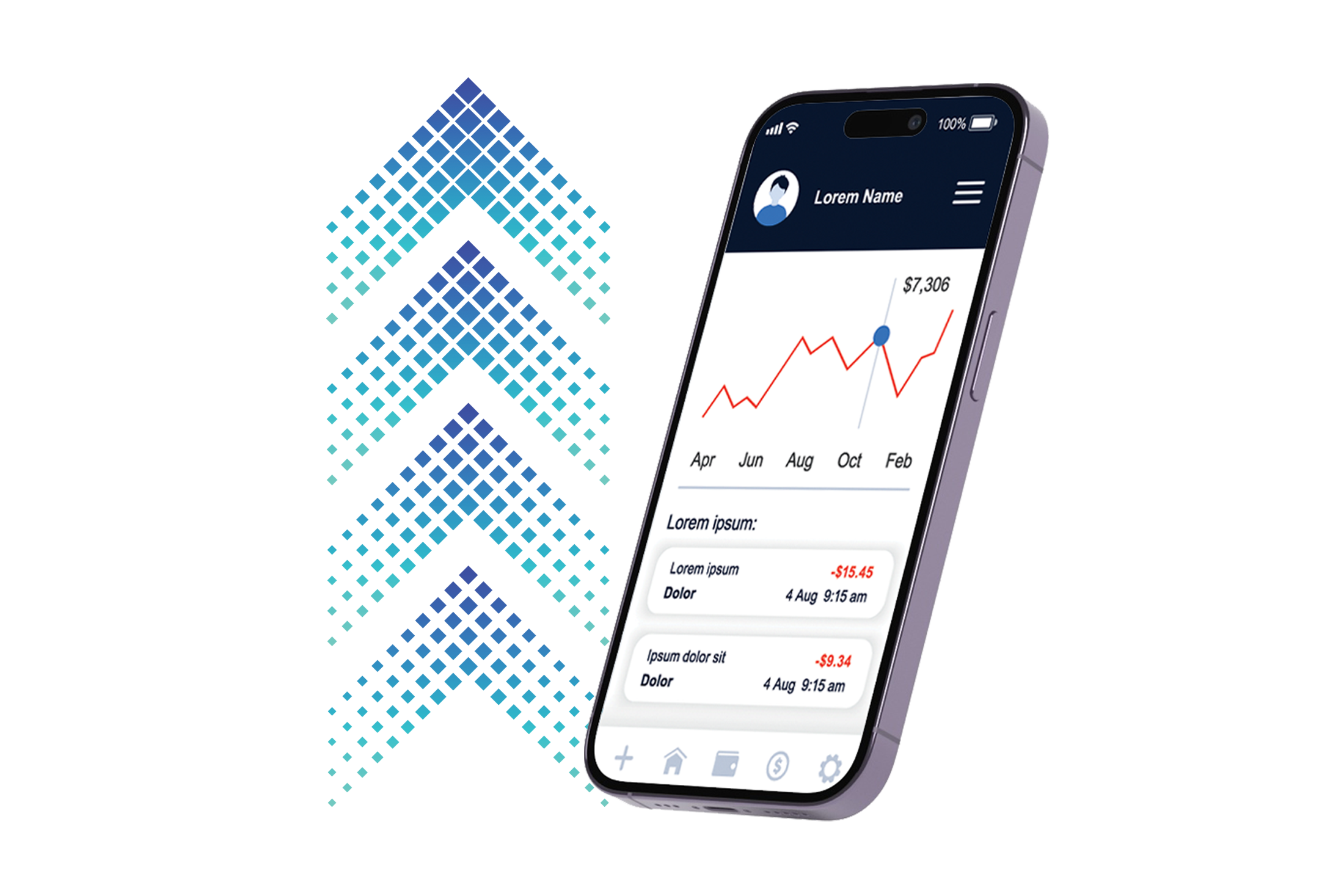

One Click Away

MotivHSA allows you to access all your HSA needs from your phone. Download our app to check spending, view and submit claims, and more. Join us on our journey to revolutionize healthcare.

Harnessing HSA Funds for Retirement

The mere thought of retirement might make one break into a cold sweat, especially when juggling student loans and rent that could rival a mortgage. However, there’s a nifty financial tool that doesn’t receive enough credit: Health Savings Accounts (HSAs).

Preparing for the School Year Ahead

It’s that bittersweet time of year when summer ends and school begins. And whether it’s more bitter or more sweet for you, there’s one thing that is certain—it’s time to prepare for the school year ahead.

HSA Myths Debunked

There are several misconceptions about HSAs, which can lead to underutilization of this amazing savings tool. Time to clear the air!