Smarter Spending

HSA dollars can be used tax-free for qualified medical expenses. HSAs already promote smarter health spending, and you ramp up your savings even more by finding ways to lower your medical bills:

Shopping for Care

Prices vary dramatically from simple check-ups to major surgeries. Be sure to shop around and even negotiate pricing before you go.

Urgent Care

Urgent care visits can be up to 5 times cheaper than emergency room visits. If you or a loved one’s life is not at risk, consider urgent care first.

Get Generic

Save 20 to 70 percent by getting generic brand drugs instead of branded medications.

Better Savings

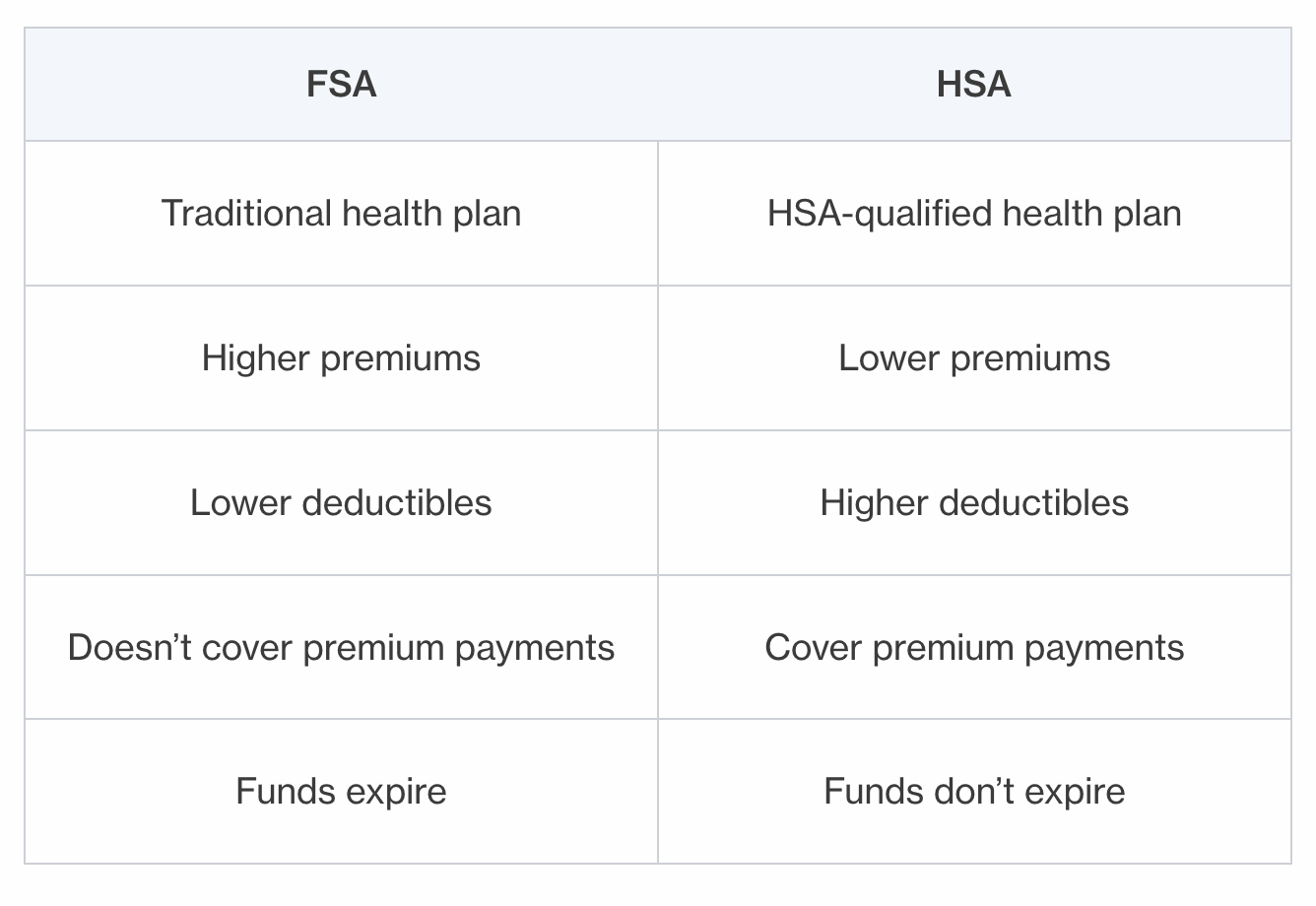

An HSA is only available with a high-deductible health plan (HDHP). HDHP means lower premiums. Save the money you didn’t spend on premiums and put them in your MotivHSA. By pairing a high-deductible health plan with an HSA, you can turn it into a “no-deductible” health plan. HSA funds also roll over year-over-year and never expire.

Save

Stop spending on “what-if” costs and use your money your way

Why HSAs

A Health Savings Account has so many advantages. HSAs involve tax breaks beyond the triple-tax advantage and are an excellent savings vehicle for retirement. Not only can HSA investments help your account keep up with inflation, but they may allow it to outrun inflation. HSA funds can be invested tax-free in mutual funds, stocks, or bonds.

Investments

Investing your HSA dollars can help create a robust retirement fund. HSA investments include 100% tax-deductible contributions and tax-free earnings on your investments. After age 65, you can use your HSA dollars for non-medical expenses, they will simply be subject to regular income tax. It’s never too late to start—invest your HSA today.

How Do I Get Started

To qualify for a Health Savings Account you need to first have a high-deductible health plan. If you have a high deductible health plan on your own—not through your employer—you can sign up right now. If you have a high deductible health plan through your employer you can sign up during open enrollment.

Why MotivHSA?

1. Better user experience

2. Faster deposits and funding of HSA contributions.

3. Simplified administration of the entire medical benefit process.

4. Enhanced incentive options to fund the HSA.

5. MotivHSA is free to clients / members.

Stop spending on “what-if” costs and use your money your way

Why HSAs

A Health Savings Account has so many advantages. HSAs involve tax breaks beyond the triple-tax advantage and are an excellent savings vehicle for retirement. Not only can HSA investments help your account keep up with inflation, but they may allow it to outrun inflation. HSA funds can be invested tax-free in mutual funds, stocks, or bonds.

Investments

Investing your HSA dollars can help create a robust retirement fund. HSA investments include 100% tax-deductible contributions and tax-free earnings on your investments. After age 65, you can use your HSA dollars for non-medical expenses, they will simply be subject to regular income tax. It’s never too late to start—invest your HSA today.

How Do I Get Started

To qualify for a Health Savings Account you need to first have a high-deductible health plan. If you have a high deductible health plan on your own—not through your employer—you can sign up right now. If you have a high deductible health plan through your employer you can sign up during open enrollment.

Heart Health Awareness

Heart Health in the U.S. Heart disease is a formidable adversary in the United States, and recent trends indicate it's only escalating. Despite...

HSAs: No Stone Left Unturned

Health Savings Accounts (HSAs) are widely recognized for their triple-tax advantage, providing an effective way to save on healthcare costs. While...

Everything You Need of Know of MHSA Investments

King of HSA Investments When combined with a high-deductible health plan, Health Savings Accounts (HSAs) offer a unique advantage by allowing you to...