Invest

There are many perks to having an HSA. Not only are they a great way to pay for medical expenses and save on taxes, but you can also invest your HSA funds to create a powerful future financial asset.

Invest

There are many perks to having an HSA. Not only are they a great way to pay for medical expenses and save on taxes, but you can also invest your HSA funds to create a powerful future financial asset.

Why Invest

Turn your HSA into a stronger retirement vehicle by investing its funds. HSA investments have many advantages, including 100% tax-deductible contributions and tax-free earnings on your investments. After you turn 65, you can use your HSA dollars for non-medical expenses (they will simply be subject to regular taxation). It’s never to late to start investing.

Why Invest

Turn your HSA into a stronger retirement vehicle by investing its funds. HSA investments have many advantages, including 100% tax-deductible contributions and tax-free earnings on your investments. After you turn 65, you can use your HSA dollars for non-medical expenses (they will simply be subject to regular taxation). It’s never to late to start investing.

How to Invest

You need to accumulate at least $2,000 in your HSA to qualify for investing with MotivHSA. Once reached, you are free to invest anything over the $2000 balance.* Once you’ve invested, you don’t have to maintain a minimum balance of $2,000 to keep your investments, but it is important to note that you won’t be able to make any new investments until you reach a $2000 balance again.

Note: Your investment balances cannot cover claim payments or purchases with your MotivHSA debit card. To use investment funds for such payments, you will first need to sell your investments.

How to Invest

You need to accumulate at least $2,000 in your HSA to qualify for investing with MotivHSA. Once reached, you are free to invest anything over the $2000 balance.* Once you’ve invested, you don’t have to maintain a minimum balance of $2,000 to keep your investments, but it is important to note that you won’t be able to make any new investments until you reach a $2000 balance again.

Note: Your investment balances cannot cover claim payments or purchases with your MotivHSA debit card. To use investment funds for such payments, you will first need to sell your investments.

INVESTMENT OPTIONS

We are proud to offer three unique products which will enhance your investment growth. Learn more by clicking on each tile.

Managed Paths

If you prefer, your investments can be automatically selected, managed, and rebalanced in accordance with age, risk profile and time horizon factors.

Self-Directed ETFs

Efficiently manage your portfolios by choosing from a pre-selected menu of investment options and opportunities for growth.

Brokerage

Connect with experienced investors for assistance with trading across investment instruments such as stocks, ETFs, and mutual funds.

INVESTMENT OPTIONS

We are proud to offer three unique products which will enhance your investment growth. Learn more by clicking on each tile.

Managed Paths

If you prefer, your investments can be automatically selected, managed, and rebalanced in accordance with age, risk profile and time horizon factors.

Self-Directed ETFs

Efficiently manage your portfolios by choosing from a pre-selected menu of investment options and opportunities for growth.

Brokerage

Connect with experienced investors for assistance with trading across investment instruments such as stocks, ETFs, and mutual funds.

Time is Money

What are you waiting for? Start investing your HSA today, and you’ll be sure to thank yourself when retirement arrives. After age 65, HSA funds can finally be used for non-medical expenses.** It really seems silly not to invest an account that allows tax-free growth, don’t you think?

* Participating in MotivHealth investments deducts a monthly fee of $3.95 from your HSA balance, and these investments are not FDIC insured.

** HSA funds used on non-medical expenses after age 65 are subject to income tax.

Time is Money

What are you waiting for? Start investing your HSA today, and you’ll be sure to thank yourself when retirement arrives. After age 65, HSA funds can finally be used for non-medical expenses.** It really seems silly not to invest an account that allows tax-free growth, don’t you think?

* Participating in MotivHealth investments deducts a monthly fee of $3.95 from your HSA balance, and these investments are not FDIC insured.

** HSA funds used on non-medical expenses after age 65 are subject to income tax.

FAQs

Why is MotivHSA the Best?

MotivHSA offers lower rates than other HSA providers. We equip you with fractional shares which gives you power to invest in stocks based on dollar amount!

What is an HSA?

In 2003, the government passed one of the most tax-advantaged pieces of legislation. This legislation allows for Americans to use tax-free dollars to save for future medical expenses using a health savings account (HSA).

Who is Eligible?

To deposit money into an HSA, you need to be enrolled in an HSA-qualified health insurance plan. An HSA-qualified health insurance plan means:

- No co-pays before the deductible has been met.

- For 2024, the minimum deductible for an individual plan is $1,600 and $3,200 for a family plan.

- For 2024, the out-of-pocket maximum costs that you pay must be capped at $8,050 for an individual plan and $16,100 for a family plan. The insurance covers the rest.

How Do I Open an HSA?

To open your HSA, simply create your account by visiting here or clicking the “Get Started” button at the bottom of the page.

Should I Invest HSA Funds?

MotivHSA has created a seamless process for you to invest your HSA dollars. You can choose to invest some of your HSA money for potential growth. It is a great way to prepare for healthcare costs in retirement. Learn more about investing here.

How Do I Qualify for Investments?

To qualify for investments you need a balance of $2000 or more. You will be able to invest anything over the $2000 balance.

Do I Need to Maintain a Minimum Balance of $2000 to Keep my Investments?

No, you just won’t be able to make any new investments if your balance goes below $2000.

Is There a Monthly Fee to Participate in Investments?

Yes. A monthly fee of $1.50 + 50 basis points

$2.50 added with a balance under $2000

Will my Investment Balance Cover Claim Payments or Purchases With my MotivHSA Debit Card?

No, your investment and HSA balances are separate. To use investment funds for claim or debit card payments, you will need to sell invested funds.

Are my Investments FDIC Insured?

No, investments carry risk and are subject to loss. Losses are not insured.

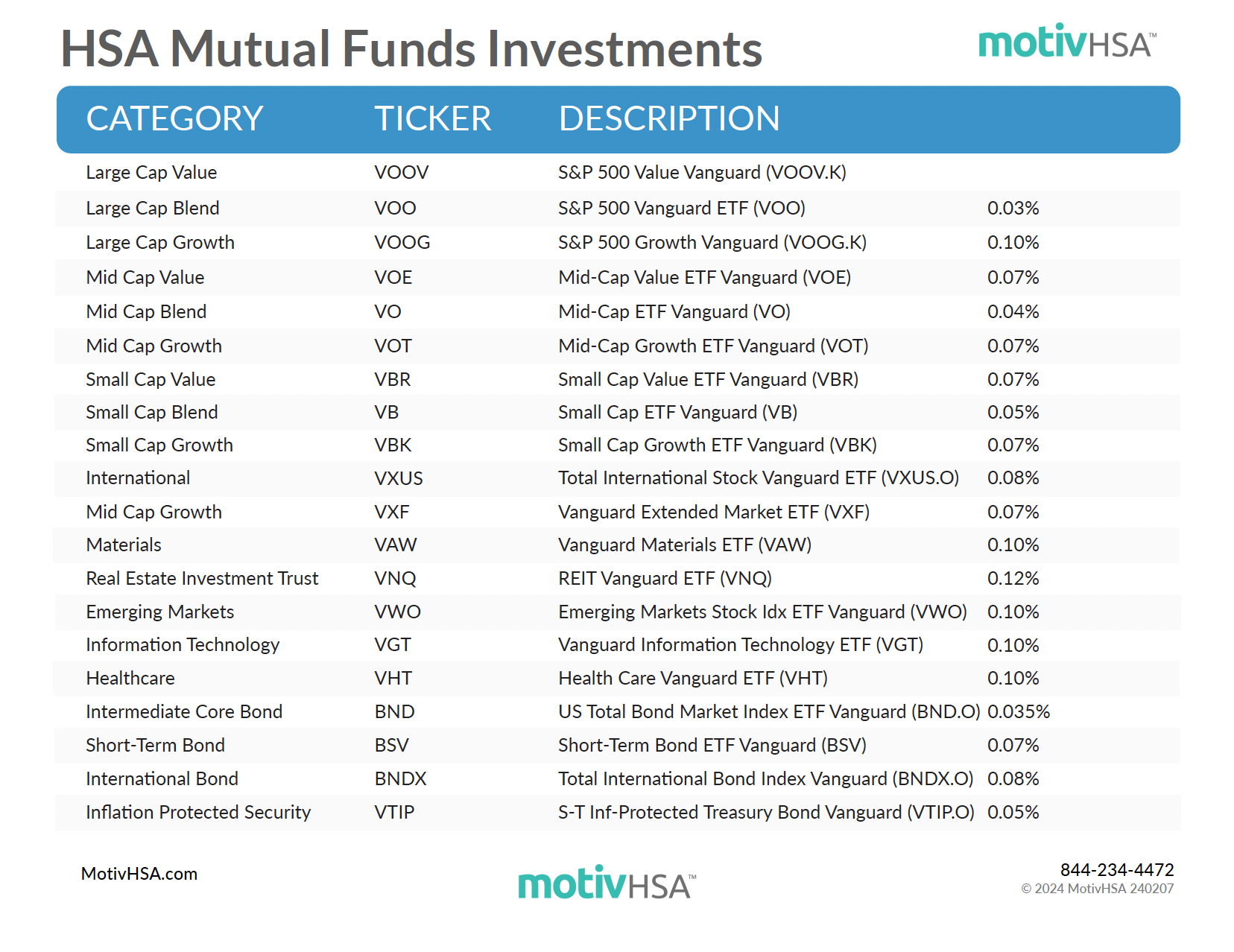

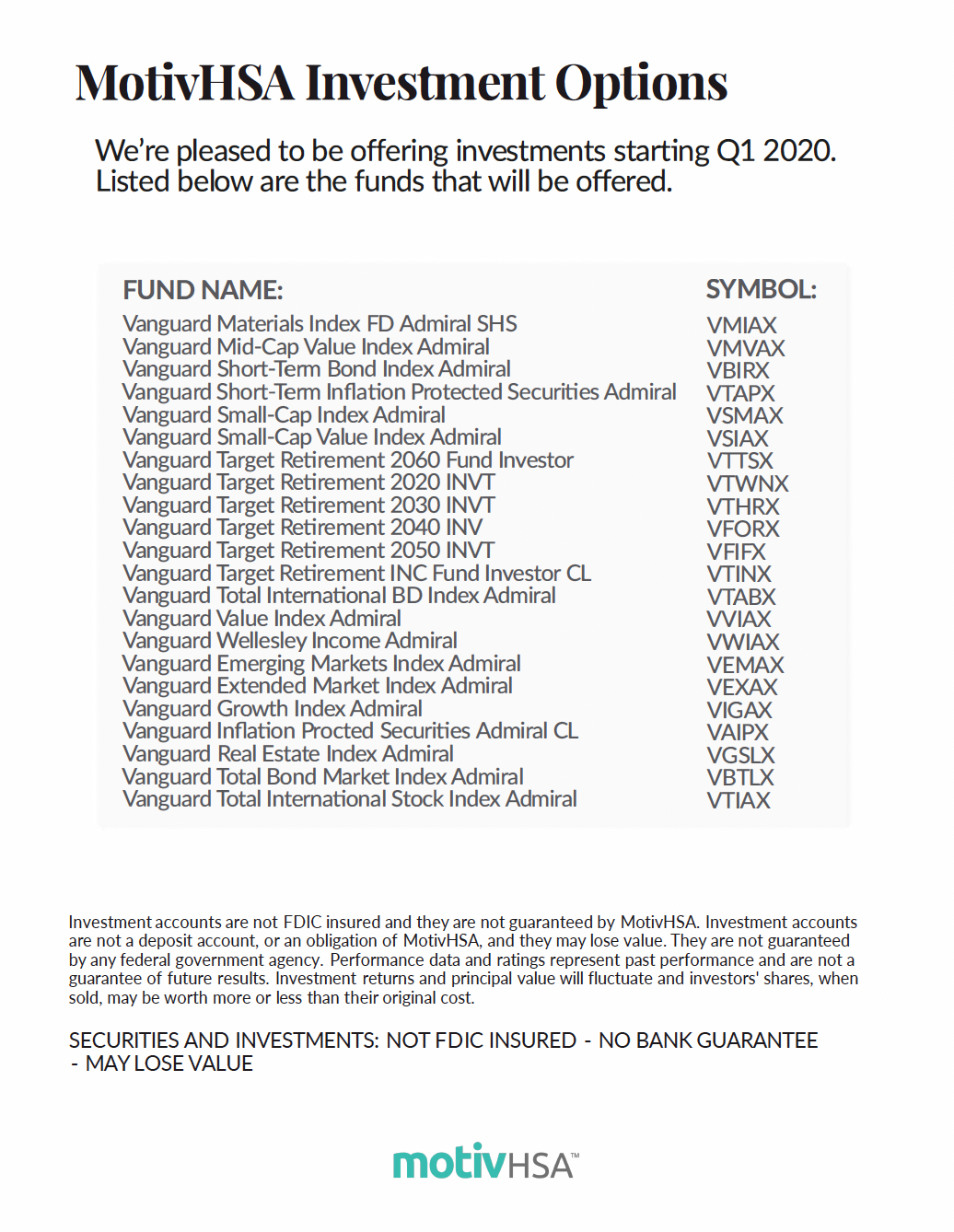

MotivHSA Investment Options

Fund Names

S&P 500 Value Vanguard

S&P 500 Vanguard ETF

S&P 500 Growth Vanguard

Mid-Cap Value ETF Vanguard

Mid-Cap ETF Vanguard

Mid-Cap Growth ETF Vanguard

Small Cap Value ETF Vanguard

Small Cap ETF Vanguard

Small Cap Growth ETF Vanguard

Total International Stock Vanguard ETF

Vanguard Extended Market ETF

Vanguard Materials ETF

REIT Vanguard ETF

Emerging Markets Stock Idx ETF Vanguard

Vanguard Information Technology ETF

Health Care Vanguard ETF

US Total Bond Market Index ETF Vanguard

Short-Term Bond ETF Vanguard

Total International Bond Index Vanguard

S-T Inf-Protected Treasury Bond Vanguard

MotivHSA Investment Options

Fund Names

S&P 500 Value Vanguard

S&P 500 Vanguard ETF

S&P 500 Growth Vanguard

Mid-Cap Value ETF Vanguard

Mid-Cap ETF Vanguard

Mid-Cap Growth ETF Vanguard

Small Cap Value ETF Vanguard

Small Cap ETF Vanguard

Small Cap Growth ETF Vanguard

Total International Stock Vanguard ETF

Vanguard Extended Market ETF

Vanguard Materials ETF

REIT Vanguard ETF

Emerging Markets Stock Idx ETF Vanguard

Vanguard Information Technology ETF

Health Care Vanguard ETF

US Total Bond Market Index ETF Vanguard

Short-Term Bond ETF Vanguard

Total International Bond Index Vanguard

S-T Inf-Protected Treasury Bond Vanguard

MotivHSA Documents

Heart Health Awareness

Heart Health in the U.S. Heart disease is a formidable adversary in the United States, and recent trends indicate it's only escalating. Despite...

HSAs: No Stone Left Unturned

Health Savings Accounts (HSAs) are widely recognized for their triple-tax advantage, providing an effective way to save on healthcare costs. While...

Everything You Need of Know of MHSA Investments

King of HSA Investments When combined with a high-deductible health plan, Health Savings Accounts (HSAs) offer a unique advantage by allowing you to...