Managed Path

New to investing or just looking for a hands off approach? Our Managed Path option will automatically select, manage, and rebalance your investments on an ongoing basis in accordance with your age, risk profile, and time horizon factors.

Managed Path

New to investing or just looking for a hands off approach? Our Managed Path option will automatically select, manage, and rebalance your investments on an ongoing basis in accordance with your age, risk profile, and time horizon factors.

Why select a managed path?

Custom Risk and Sentiment

Customize your risk management strategy to resonate with the current market sentiments and adjust strategies accordingly.

Low Effort Approach

We’ll take care of tailoring investment plans to fit your risk comfort level, so you can relax and leave the details to us. Our experts will steer you towards achieving your financial objectives.

Transparency

Managed Path investors benefit from transparent disclosure of asset transactions. This transparency enhances the understanding and oversight of their investment activities.

Why invest with MotivHSA?

User-friendly Interface

Customer Support

Competitive Fees

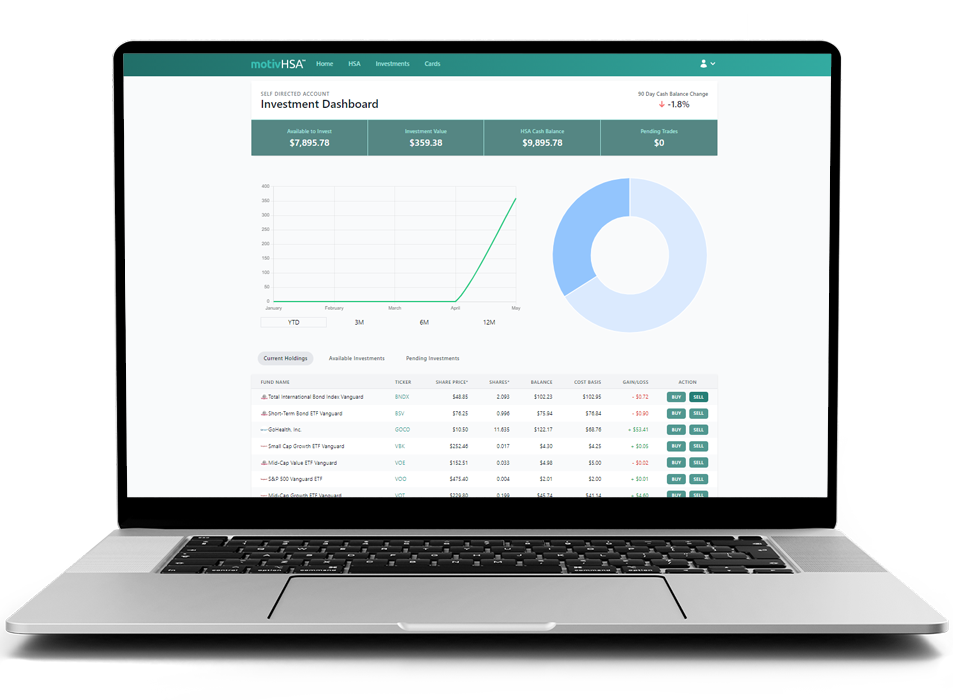

Take a Peak

Advanced technology with a simple interface.

Frequently Asked Questions

What are the fees associated with a managed path?

Administrative Fee:

For accounts maintaining a balance exceeding $2000 USD, no administrative fees are applicable. However, accounts with balances below this threshold are subject to a monthly fee of $2.50.

Management Fee:

A monthly management fee of $1.50 is applied to ensure the efficient management and longevity of the account.

Investment Fee:

We impose an investment fee equivalent to 50 basis points annually on the invested balance over a 12-month period. As an illustration, if your investment amounts to $5000, the fee would be calculated as follows: 0.0004166 (50 basis points) x $5000 = $2.08.

How does this compare to a 401k

When considering investment options, Health Savings Accounts (HSAs) offer unique advantages over 401(k) retirement accounts. HSAs are specifically tailored for healthcare expenses, providing pre-tax contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses, alongside the potential for investing in a variety of securities. Unlike 401(k) plans, which primarily focus on retirement savings and may have limitations on investment choices, HSAs allow individuals to build wealth while simultaneously covering current and future healthcare costs, offering flexibility and tax advantages that make them an attractive option for investment-minded individuals seeking to maximize their savings potential and optimize their tax strategy.

We got you covered with proven selections.

You have the flexibility to invest based on your preferences, at your convenience, and adjust your choices in the moment to align with your needs. We have taken out that hard work so you can sit back and let your investments grow.