Brokerage

Investors who are experienced in advanced research, filters, and trading will benefit for our brokerage investment path. This path gives access to thousands of investment instruments including stocks, ETFs, and mutual funds.

Brokerage Trading

Investors who are experienced in advanced research, filters, and trading will benefit for our brokerage investment path. This path gives access to thousands of investment instruments including stocks, ETFs, and mutual funds.

Key Benefits of a Brokerage

Participate in Individual Stocks

Investors weigh the higher risk and potential returns of individual stocks against the lower risk and modest returns of investment vehicles like mutual funds.

Potential for Higher Return

Unlike standard HSA savings accounts that offer limited interest, a brokerage account enables you to pursue higher returns through a variety of investment opportunities.

You Take Full Control

Control your investments to experience growth by making informed decisions aligned with your personal goals, leveraging the autonomy to shape your financial journey.

Why invest with MotivHSA?

User-friendly Interface

Customer Support

Competitive Fees

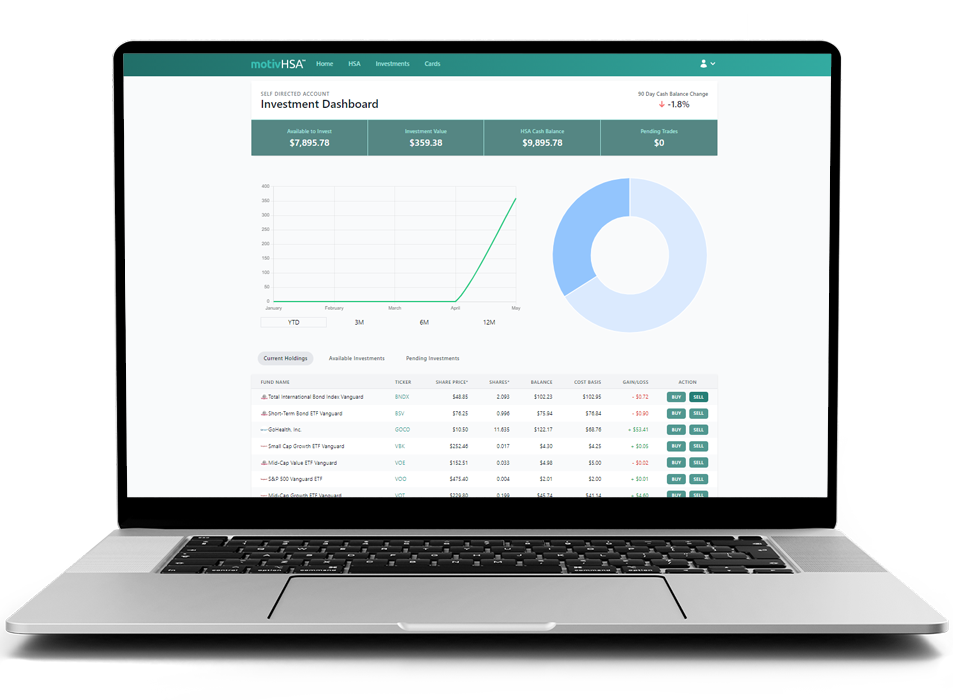

Take a Peak

Advanced technology with a simple interface.

Frequently Asked Questions

What are the fees associated with a brokerage

Administrative Fee:

For accounts maintaining a balance exceeding $2000 USD, no administrative fees are applicable. However, accounts with balances below this threshold are subject to a monthly fee of $2.50.

Management Fee:

A monthly management fee of $1.50 is applied to ensure the efficient management and longevity of the account.

Investment Fee:

We impose an investment fee equivalent to 50 basis points annually on the invested balance over a 12-month period. As an illustration, if your investment amounts to $5000, the fee would be calculated as follows: 0.0004166 (50 basis points) x $5000 = $2.08.

How does this compare to a 401k

When considering investment options, Health Savings Accounts (HSAs) offer unique advantages over 401(k) retirement accounts. HSAs are specifically tailored for healthcare expenses, providing pre-tax contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses, alongside the potential for investing in a variety of securities. Unlike 401(k) plans, which primarily focus on retirement savings and may have limitations on investment choices, HSAs allow individuals to build wealth while simultaneously covering current and future healthcare costs, offering flexibility and tax advantages that make them an attractive option for investment-minded individuals seeking to maximize their savings potential and optimize their tax strategy.

With Great Power Comes Great Responsibility

You have the flexibility to invest based on your preferences, at your convenience, and adjust your choices in the moment to align with your needs. We have taken out that hard work so you can sit back and let your investments grow.