Maximize the Potential of Your HSA

Unlock the capability of your healthcare savings with MotivHSA’s robust investment platform. Our members yield an average return of 14%.

Invest Smarter.

We offer robust investment paths tailored to you.

Managed Path

SET IT AND FORGET IT

Your investments can be automatically selected, managed, and rebalanced in accordance with age, risk profile and time horizon factors.

Self Directed ETFs

SELECT FROM A REFINED LIST

Manage your portfolio by picking from our pre-vetted and monitored ETF menu, providing you with enhanced control.

Brokerage

SELF DIRECTED INVESTMENTS

Explore the possibilities of individual stocks, ETFs and mutual funds. You are in control to determine your level of risk.

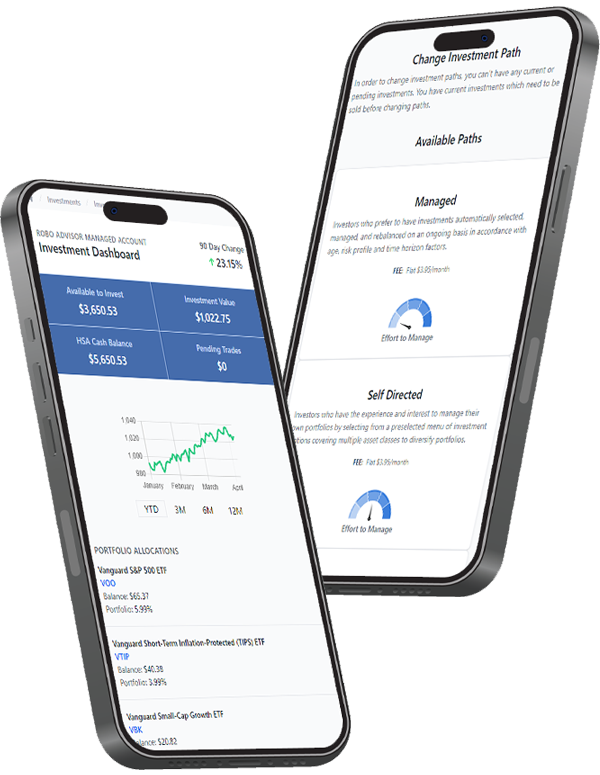

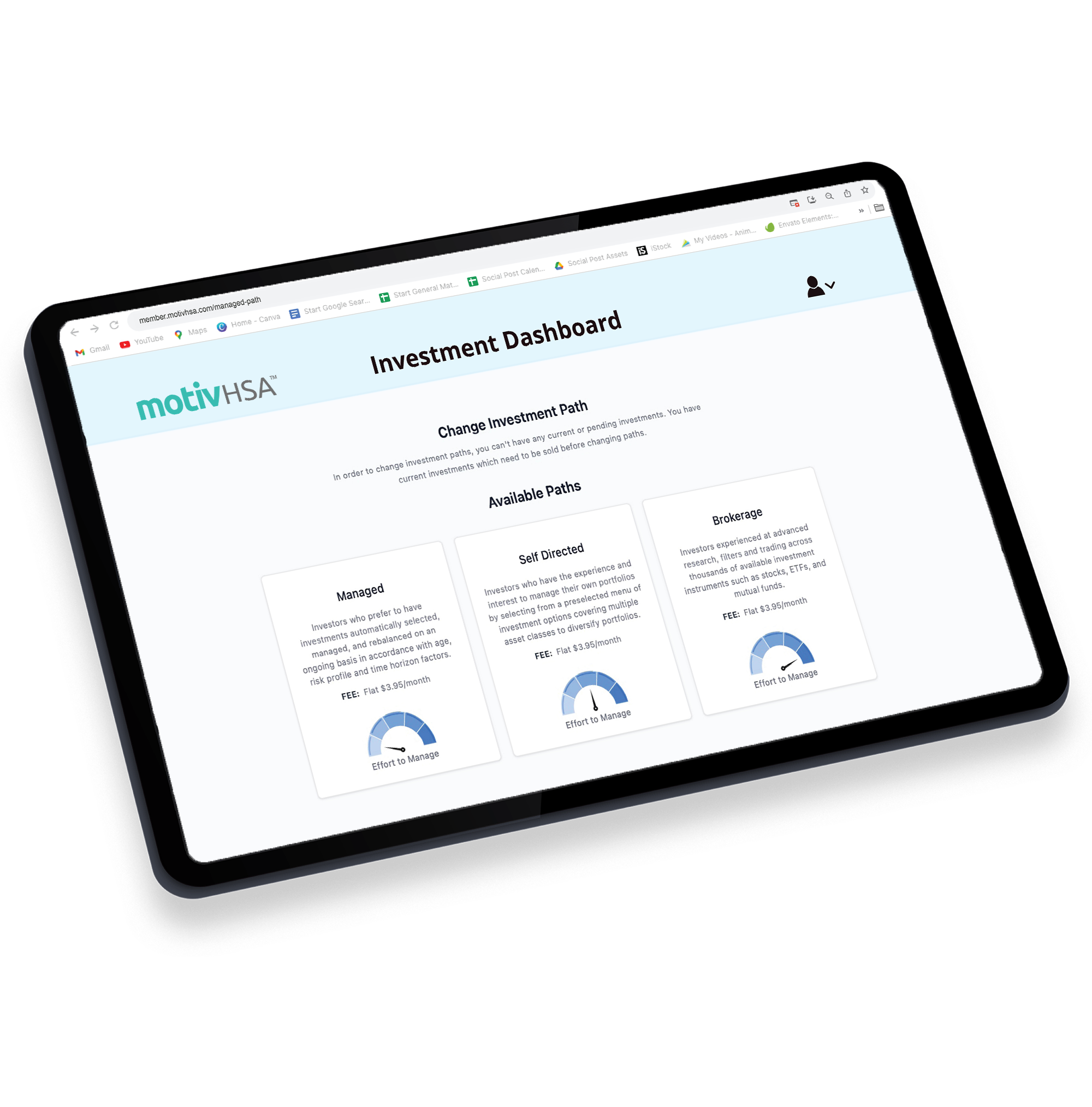

Invest Smarter.

We offer robust investment paths tailored to you.

Managed Path

If you prefer, your investments can be automatically selected, managed, and rebalanced in accordance with age, risk profile and time horizon factors.

Self-Directed ETFs

Empower yourself in managing your portfolio by picking from our pre-vetted ETF menu, providing you with enhanced control.

Brokerage

Unlock the complete brokerage experience with a fully managed account offering fractional shares, ETFs, and Mutual funds, all conveniently at your fingertips.

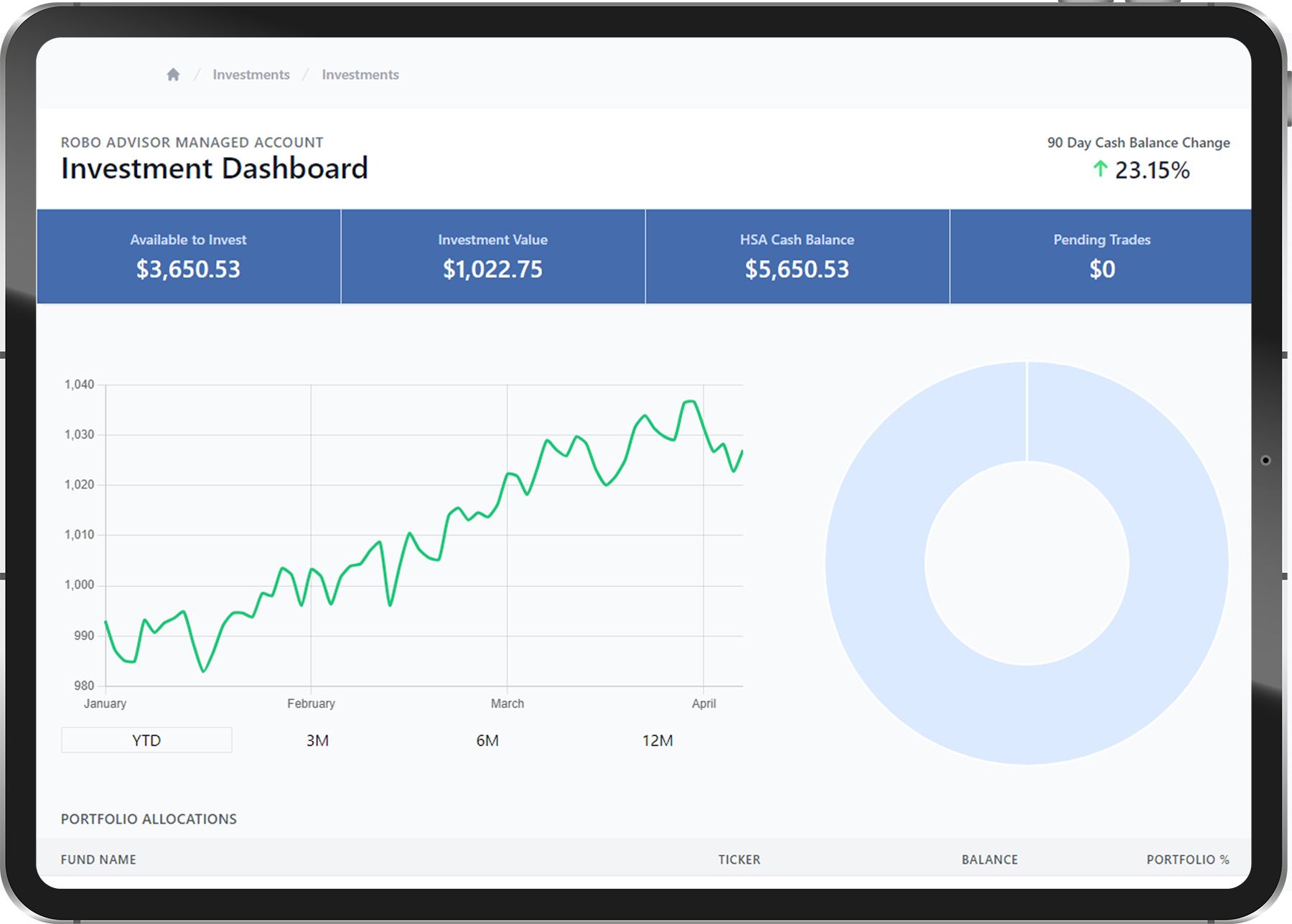

Growing Your Funds is Our Business

Our integrated platform gives you full control with seamless connections to key markets.

It’s easy to invest in the big names you are familiar with.

Capitalize on the Potential of your HSA

Investing your HSA funds can potentially earn higher returns compared to leaving them in a traditional savings account, maximizing your tax-free growth potential. Use the Triple Tax Advantage and learn more below.

Reduce your taxable income

Health Savings Accounts (HSAs) reduce taxable income by allowing pre-tax contributions, where the money you contribute is deducted from your gross income before taxes are calculated.

Compounded Growth

With HSAs, any interest or investment earnings accumulate tax-free, meaning you don’t pay taxes on the growth as long as it’s used for qualified medical expenses. This allows your HSA balance to potentially grow faster, enhancing your ability to cover future healthcare costs while reducing taxable income.

Qualified Withdrawls

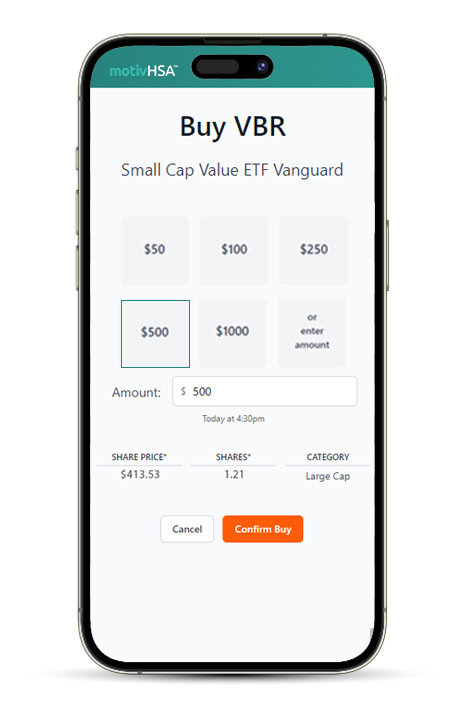

Unlock Trading Options with Fractional Shares

We make it easy to buy and sell fractional shares. Instead of being limited to buying the full value of one share, you can buy fractions of it. Through our different investment paths, you can choose what fits best for you.

It’s easy to invest in the big names you are familiar with.

Founded in 2015

$50M+

Assets under management

25K+

Trusted users

Let’s Break Down the Cost

HSA Fees

Administrative Fee:

Zero fees on accounts over $2000 USD. Accounts with balances below this threshold are subject to a monthly fee of $2.50.

Investment Fees

Administrative Fee:

Zero fees on accounts over $2000 USD. Accounts with balances below this threshold are subject to a monthly fee of $2.50.

Management Fee:

A monthly management fee of $1.50.

Investment Fee:

50 basis points annually on the invested balance over a 12-month period. Capped at $250 a year.

Do More With Our Advanced Platform

From seasoned investors to beginners, our intuitive interface empowers you to make informed decisions, manage your portfolio, and stay ahead of market trends. Achieve your financial goals with clarity and confidence.