What is a Health Savings Account?

Health Savings Accounts (HSAs) are member-owned accounts with tax advantages, allowing you to set aside pre-tax dollars for future qualified medical expenses. You have the opportunity to invest funds tax-free. The funds in the account do not have an expiration date and are yours forever!

Why Choose Us

- 3 in 1 Investment Platform

- Convenient Account Management

- Versatile Savings Account

- Engaged Member Service Team

- Receive a Triple Tax Advantage

Why Choose Us

- 3 in 1 Investment Platform

- Convenient Account Management

- Versatile Savings Account

- Engaged Member Service Team

- Receive a Triple Tax Advantage

Spend

HSA Qualified Medical Expenses

You can save an average of 30 percent on qualified medical expenses because of tax savings on contributions. View a list of qualified medical expenses here.

Use Your HSA Card

Using your HSA card for medical expenses allows you to spend tax-free dollars. When using your HSA you can save money while you spend it.

Smart Spending

Take Charge

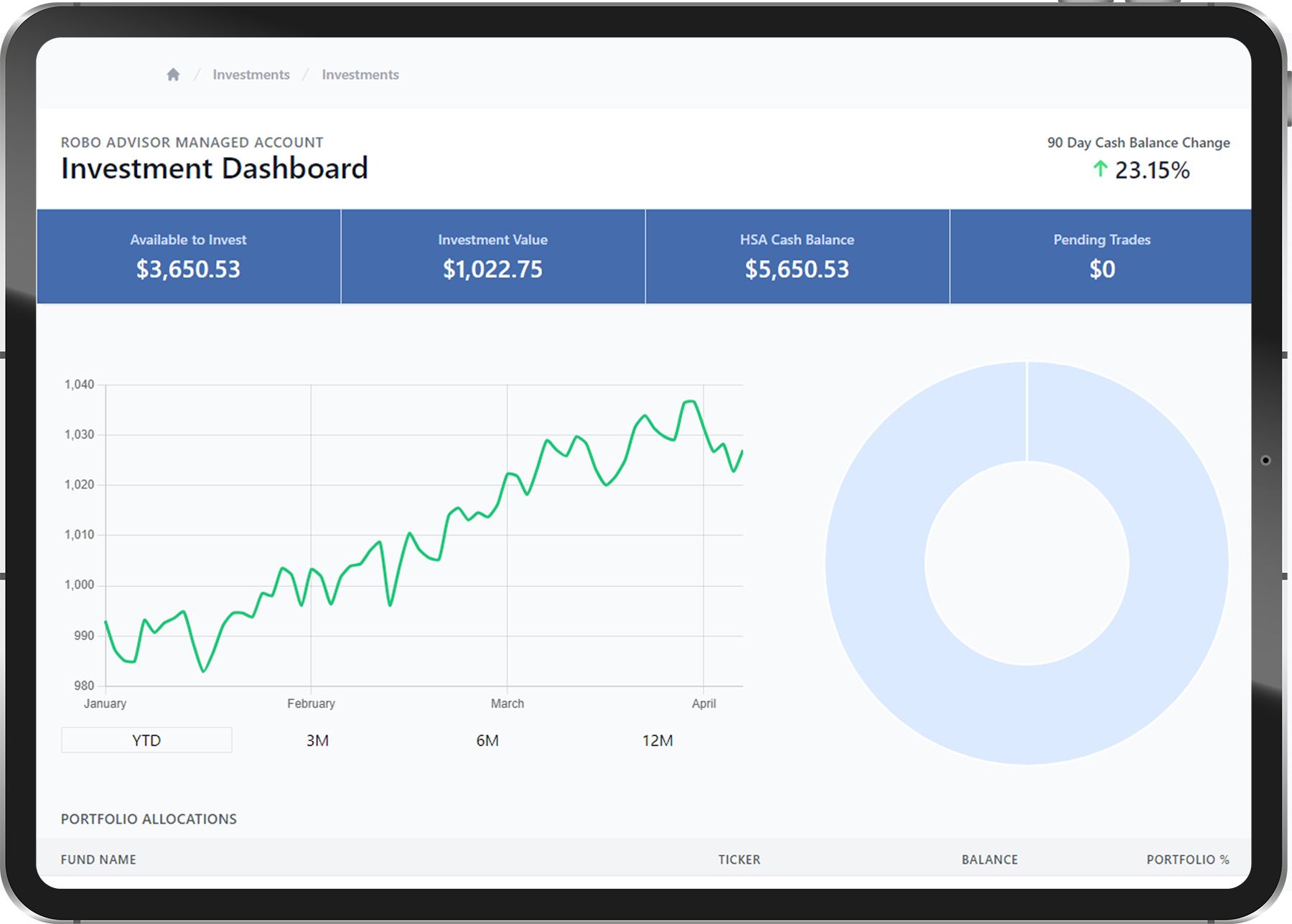

Investment Paths

Managed Paths

New to investing? Our managed path will automatically select, manage, and rebalance your investments on an ongoing basis in accordance with your age, risk profile, and time horizon factors.

Self Directed ETF

Those interested in managing their own investment portfolios will benefit from our self-directed ETF investment path. This path has a preselected menu of investment options you can choose from that cover multiple asset classes to diversify your portfolios.

Brokerage Accounts

Members who are experienced in advanced investment research, filters, and trading will benefit from our brokerage investment path. This path gives access to thousands of investment instruments including stocks, ETFs, and mutual funds.

Get Started

Join 26k+ Members Today

We eagerly anticipate your participation on our platform as you enhance your HSA experience.

National Women’s Health Week

This week is National Women’s Health Week. Womanhood comes with many challenges, including several female-specific health issues. We want to...

Fight Inflation with HSA Investments

Fighting Inflation Congrats to Inflation on Its Personal Record Inflation is currently at an all-time high, and that’s not just a figure of speech....