What is a Health Savings Account?

Health Savings Accounts (HSAs) are member-owned accounts with tax advantages, allowing you to set aside pre-tax dollars for future qualified medical expenses. You have the opportunity to invest funds tax-free. The funds in the account do not have an expiration date and are yours forever!

Why Choose Us

- 3 in 1 Investment Platform

- Convenient Account Management

- Versatile Savings Account

- Engaged Member Service Team

- Receive a Triple Tax Advantage

Why Choose Us

- 3 in 1 Investment Platform

- Convenient Account Management

- Versatile Savings Account

- Engaged Member Service Team

- Receive a Triple Tax Advantage

Spend

HSA Qualified Medical Expenses

You can save an average of 30 percent on qualified medical expenses because of tax savings on contributions. View a list of qualified medical expenses here.

Use Your HSA Card

Using your HSA card for medical expenses allows you to spend tax-free dollars. When using your HSA you can save money while you spend it.

Smart Spending

Take Charge

Investment Paths

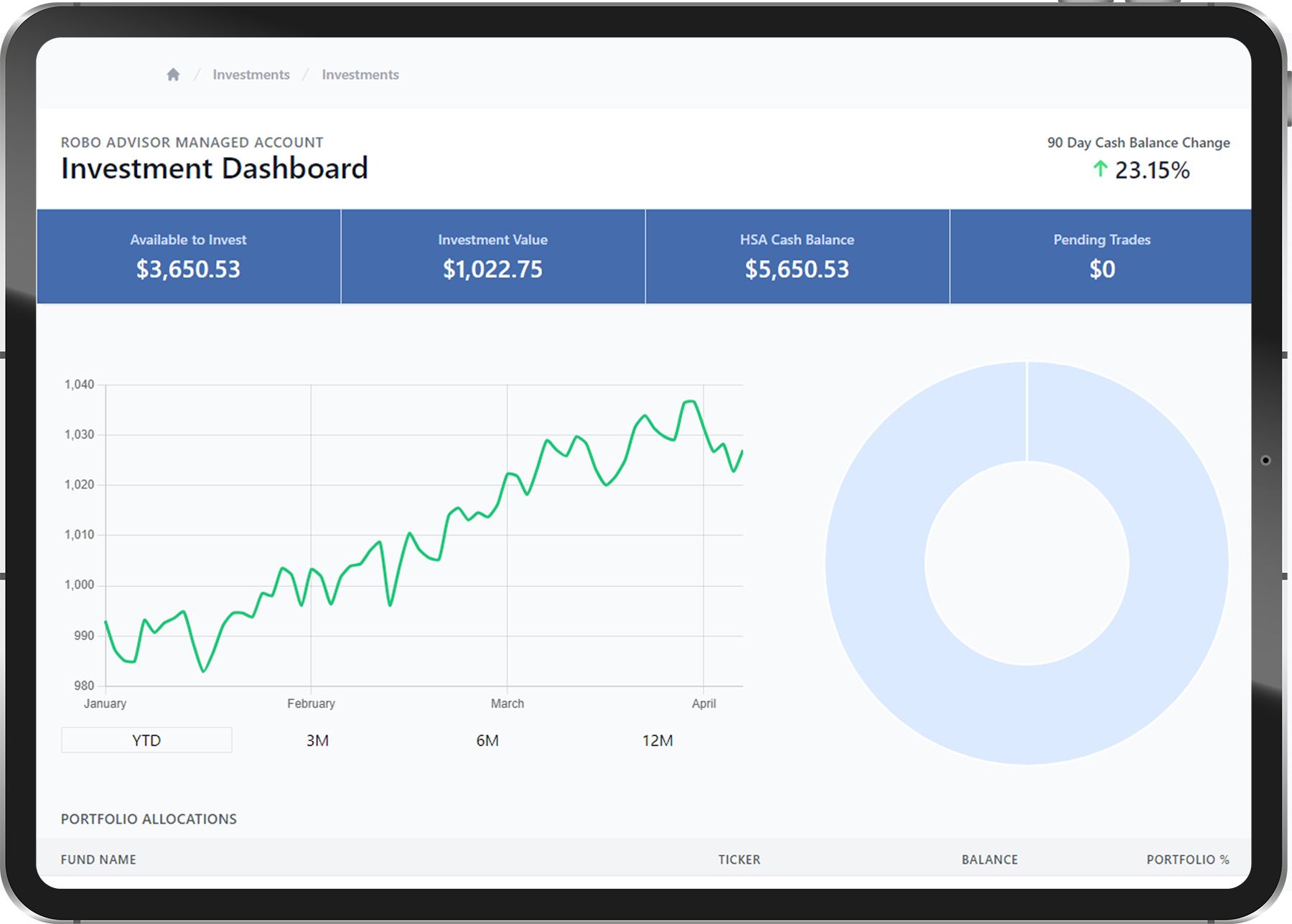

Managed Paths

New to investing? Our managed path will automatically select, manage, and rebalance your investments on an ongoing basis in accordance with your age, risk profile, and time horizon factors.

Self Directed ETF

Those interested in managing their own investment portfolios will benefit from our self-directed ETF investment path. This path has a preselected menu of investment options you can choose from that cover multiple asset classes to diversify your portfolios.

Brokerage Accounts

Members who are experienced in advanced investment research, filters, and trading will benefit from our brokerage investment path. This path gives access to thousands of investment instruments including stocks, ETFs, and mutual funds.

Get Started

Join 26k+ Members Today

We eagerly anticipate your participation on our platform as you enhance your HSA experience.

HSA Annual Contribution Limits Are Going Way Up

HSA contribution limits are rising at a higher percentage than ever before in 2024. Couples 55 and older will be able to contribute over $10,000!

HSAs: A Slept-On Retirement Vehicle

Given recent inflation, you may be starting to feel like you’d have to win the lottery to carry yourself through retirement. Fortunately, there’s a...

Men’s Health Awareness

Studies show that men are half as likely to go to the doctor as women. Considering that men are more likely to develop heart disease, high cholesterol, and high blood pressure than women.