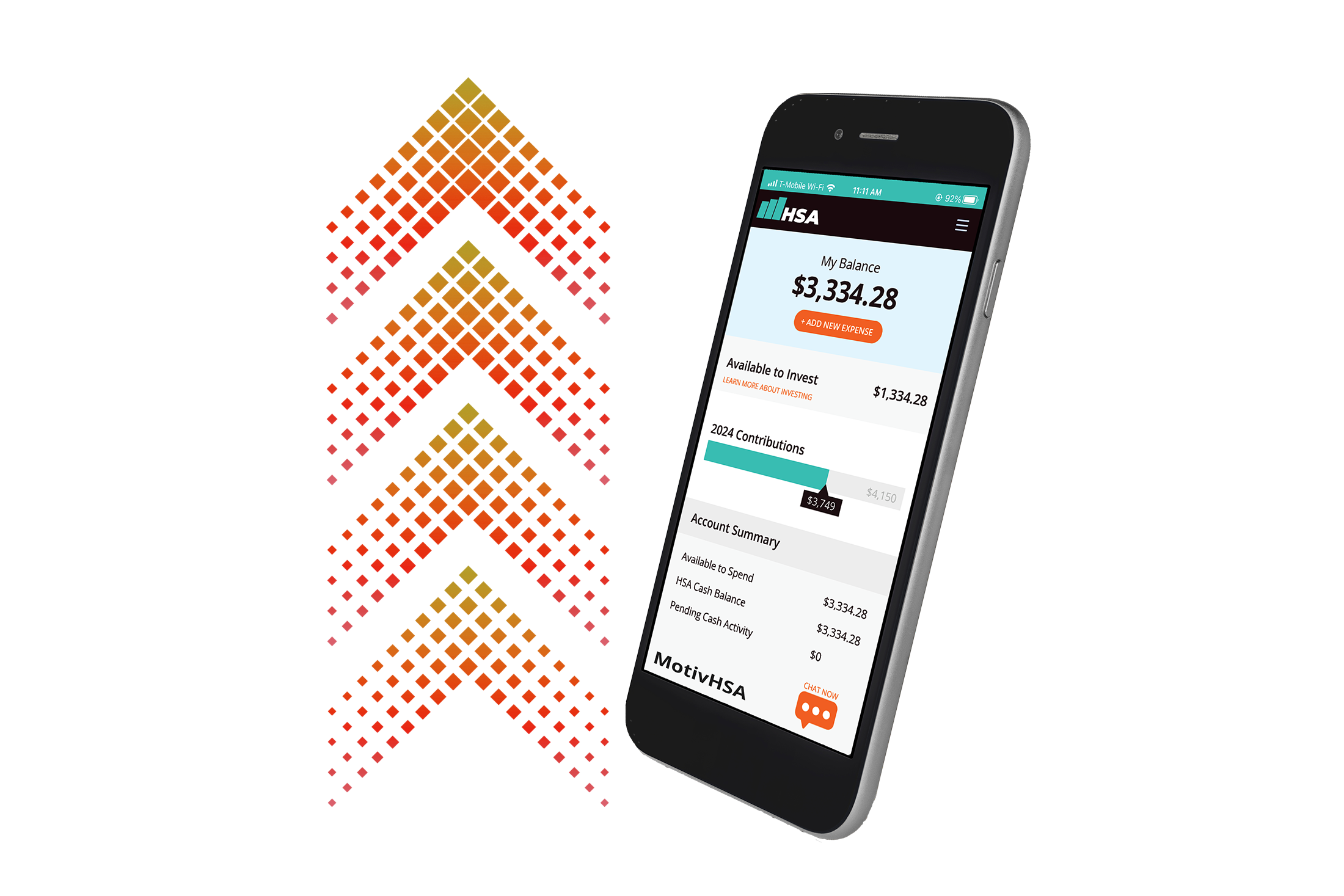

Introduction to Your HSA

Through your HSA plan at MotivHSA, you are able to make tax-free contributions into your health savings account (HSA) and use your health savings for all qualified medical expenses (QMEs), tax-free as well. Remember: Since you save on premiums with an HSA plan, you can put the money you would have paid towards premiums into your HSA to build health savings for the future.

HSA Overview

HSA Eligibility

Before you can open and contribute towards a health savings account (HSA), the IRS requires you to be covered by an HSA-qualified health plan, not have any other health coverage, and not be claimed as a dependent on anyone’s tax return. There are, however, a few allowed coverages for things like accidents, disability, dental care, and long-term care. For more information concerning HSA eligibility, please see: IRS Publication 969.

Contributors

Anyone is able to make contributions to your health savings account. This means that you, your spouse, or your employer, can all contribute. Please note that, though anyone can make a contribution to your HSA, only you can benefit from contributions as a deduction on your personal tax return. You will not need to claim any contributions made to your HSA by others on your federal tax return.

Contribution Deadlines

You are able to make HSA contributions until the tax filing deadline for the year, without extension. Payroll contributions are applied to the calendar year they were made in. Contributions for the preceding tax year can be made either by check or an electronic funds transfer (EFT).

Contribution Limits

Spouses and Other Tax Dependents

Your health savings can be used towards qualified medical expenses for both you and your spouse and tax dependents (even if the dependent is not covered under your health plan).

HSA Contribution Qualifications

Your annual HSA contribution limit is based on two things:

- How many months of coverage by an HSA plan

- Coverage type; either individual or family

Last-month rule

According to the last-month rule, if you are HSA-eligible on the first day of the last month of the tax year, you are considered eligible for the entire year. Under this rule, you will be able to make full HSA contributions during that year.

Testing Period

The testing period means that, if you used the last-month rule, you must remain HSA-eligible for 12 months; starting with the last month of your tax year until the last day of those 12 months. During the testing period you are not required to contribute to your HSA, but you will not be able to switch to a non-high deductible health plan during that time.

Medical Expenses

You can use your health savings, tax-free, for qualified medical expenses whenever you or your eligible dependents need. You are able to pay providers directly from your HSA, or you can pay out-of-pocket. If you pay out-of-pocket, you can reimburse yourself anytime later on; just be sure to keep documentation of the expense (either a receipt or EOB). If you are audited by the IRS, you will need to provide this documentation.

Direct Payments to Providers

After receiving an invoice from your provider and compared the amounts with an EOB from your health plan, you can make a direct payment to your provider for services through your MotivHealth member portal.

Your HSA Debit Cards and Payments

With your MotivHealth debit card, you can pay your providers directly with your available HSA savings. Your HSA debit card will only work at applicable medical facilities and with other qualified medical expenses. Be sure to save all receipts to serve as documentation of your purchases.

Qualified Medical Expenses

All qualified medical expenses (QMEs) are determined by the IRS and include medical, dental, vision and prescription costs. Some noteworthy QMEs are diabetic supplies, immunizations, physical therapy, birth control, and more.

Qualified Dependents

Only qualified dependents can acquire qualified medical expenses. Qualified dependents include the following:

- You and your spouse (if applicable)

- Any dependent claimed on your tax return

Any person you could have claimed, except that:

- The person filed a joint return

- The person had a gross income of or exceeding $4,050

You or your spouse, if filing jointly, could be claimed as a dependent on someone else’s tax return.

Non-Qualified Medical Expenses

If you use HSA funds for non-qualified medical expenses, the federal penalty is 20% for those under 65 years of age. You will also lose tax-free treatment for payment. Be sure to save itemized receipts and over-the-counter prescription copies in case your are audited by the IRS.

Tax Advantages

IRS Form 1099-SA

Payments from your HSA account will be reported on the IRS Form 1099-SA. You are not required to include amounts reported on this form as income unless used for non-QMEs. This form is mailed by the end of January each year and is necessary to include when filing your tax return. If there are any errors on this form, be sure to contact MotivHealth as soon as possible.

IRS Form 5498-SA

You will report all contributions and rollovers to your account using Form 5498-SA. Because you are able make HSA contribution until the tax filing deadline, this form is delivered in May of each year and will include all contributions for the given tax year. HSA contributions are reported in box 2, box 3 and box 4.

- Box 2: All contributions made during the calendar year (regardless of tax year)

- Box 3: Contributions made after the end of the calendar year that were labeled as prior year contributions

- Box 4: Any amount that rolled over from another HSA

- Box 5: FMW as of December 31

IRS Form 8889

To complete and submit your annual tax return, your tax preparer will use your 1099-SA, W-2 and other documents when necessary. As mentioned previously, IRS Form 8889 will be used to calculate your HSA deductions report payments.

Tax Reporting

Because you receive tax-advantages from holding an HSA, you are required by the IRS to report your account usage on your income tax return using Form 8889. This form will be used by your tax preparer to calculate your HSA deductions report payments. See below for more information on Form 8889.

Invest Today

Join 28k+ users

We eagerly anticipate your participation on our platform as you enhance your HSA investment approach

Invest Today

Join 28k+ users

We eagerly anticipate your participation on our platform as you enhance your HSA investment approach